Jason Noble debuts Portfolio PaydayTM, our latest service to help you stay on top of your finances.

It seems like each month this year brings more and more challenging topics toward us as a country. You may have heard me say before, “Money is not blue, nor is it red, but it’s green.” I try not to input my own political or personal views when it comes to your finances. Thus, I usually stay away from certain conversations. However, with a landmark Supreme Court decision coming recently regarding Roe v. Wade, I wanted to take some time to share my perspective. My heart goes out to those making challenging decisions, as often there is no decision that sits right with everyone.

When I was class treasurer for my senior year in high school, we had 98 teen parents out of a class of 453 students. Teen pregnancy was obviously a huge issue in my high school. As class treasurer, I had the chance to hear stories from my fellow classmates that have stayed with me all these years. What I learned back then, and feel is worth sharing today, was two things:

- First, provide grace to those who have to make impossible decisions, and do so without passing any judgment.

- Second, it is more important to show love and appreciation toward someone than it is to show love toward being right.

While as a man of faith I practice those two things today, I also took action many years ago. As class treasurer, I worked with the committee, parents, classmates, and the school board for two important initiatives. One was for funding the “Baby Think it Over” Program, which included baby dolls with multiple keys to have teens experience what it was like to have a real baby. This made a higher impact than carrying an egg around for a week and resulted in a $1 million donation from March of Dimes after hearing a about the journey one of my classmates as a student parent. The second initiative was to fund childcare so student-parents could continue their education while their children were properly cared for during school hours. Children raising children need support. As a 17-year-old, my world was small, but it was big enough to show grace toward those classmates who had to make impossible decisions. We live in an amazing country, and it’s my hope that we, as a collective population, can come together to adopt principles of grace and acceptance.

In my last newsletter, I hinted at a big announcement for a service I am expanding out to all of my clients. That service is referred to as “Portfolio PaydayTM.” So, let’s take a step back and discuss how most Americans focus on their cash flow, for any and all of life’s unexpected occurrences…

When money comes in from work, after savings and taxes, it goes to a checking account hosted by a bank. From there, money is spent toward mortgages/rent, bills, credit cards, etc. After that, maybe and I mean maybe, money would go toward short-term or long-term goals by saving into an emergency account or investment account.

How and why do I say maybe? Well, a Bankrate survey from March 2022 showed that 64% of Americans live paycheck to paycheck while 56% don’t have the savings to pay for an unexpected $1,000 expense.

Another study showed that 17% of Americans who make over $100,000 per year cannot cover an unexpected $400 expense. This is a problem that includes people from all economic or socioeconomic statuses.

What is Portfolio PaydayTM:

Instead of your paycheck going to your bank, it goes into a taxable investment account (individual, joint or trust account). Within that taxable investment account, an emergency cash buffer would be created with the initial deposits, and once the cash meets the goal, additional deposits will go toward investments.

Once or twice a month, whichever is preferred by my clients, a Lifestyle Paycheck will go directly to their checking accounts for their lifestyle spending.

Real Life Example: A married couple who has a net income of $17,000 per month lives a lifestyle requiring $14,000 worth of expenditures per month. For their financial plan, they need three months’ worth of expenses saved for emergencies, or $42,000.

- Once we exceed $42,000 in the cash buffer, the additional deposits are invested into long-term investments.

- The Lifestyle Paychecks are sent from the cash buffer, and new deposits replenish the cash each time. (We do this to avoid selling long-term investments every month. If an emergency comes up, we have the cash available to send to their bank within 2 business days.)

- Also, if a goal comes up, like a vacation in a year’s time frame, we can send additional money to their bank’s savings account so that when that trip occurs, they have the cash in the bank to pay for the whole vacation. (If they spent a little more, we have them covered with the cash buffer.)

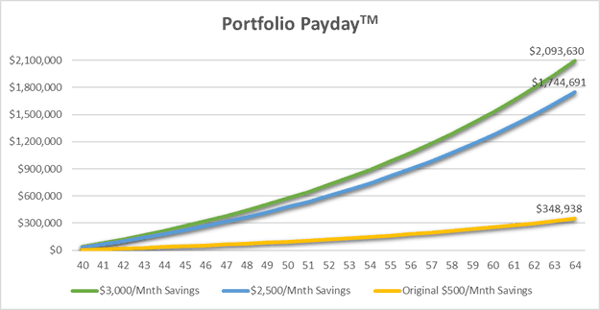

- This couple went from saving $500 per month to now saving $3,000 per month. They are in their early 40s and are set to retire at 65 years old. By leveraging Portfolio PaydayTM, assuming they continue to save $3,000 per month for 25 years, and earn 6% on average on their investments, they would have an additional $2.09 million in their retirement plan!

- What if they needed to increase their Lifestyle Paycheck to $14,500, thus saving $2,500 instead of the $3,000 per month. With all other factors staying the same, they would have an additional $1.74 million instead of the $2.08 million.

I wrote “additional” with the intention that the total would be on top of their savings through their work into their 401(k), 403(b), or other type of retirement plan. With that additional savings, they can retire sooner, live a more robust retirement, have an automated cash flow plan, and avoid having to budget on a day-to-day basis. Here is a chart to show how Portfolio PaydayTM helped this couple:

To summarize, Portfolio PaydayTM aims to help with the here and now by having three to six months’ worth of expenses saved in a cash buffer and to help pay your future self.

Please Click Here to schedule a meeting to discuss your cash flow and see how Portfolio PaydayTM can help you!

The goal of Portfolio Payday™ is to get you to a more robust retirement sooner, giving you the chance to chase your dreams at the earliest age possible. With Portfolio Payday™, you are your own boss, paying yourself today and in the future.