As challenging as international investing has been over the past several years, it has also never been more important. While developed and emerging markets may be more susceptible to economic shocks, geopolitical instability, and factors such as the pandemic, this is also why they may have higher expected returns in the long run. Investing across geographies, especially when valuations are attractive, is an important way to improve diversification as the global economy recovers from recent energy and inflationary shocks. How can investors maintain perspective around international investments today?

Global stocks are still in the red this year due to geopolitical risks around Russia’s invasion of Ukraine, high energy prices, increased tensions with China, and many other challenges. With dividends, U.S. markets are still in correction territory with the S&P 500 down over 10% and the MSCI All Country World Index down 13%. The MSCI EAFE Index of developed markets has fallen 16% in U.S. dollar terms and 4% in local currency terms. Similarly, the MSCI Emerging Markets Index has declined 17% in dollar terms and 14% in local currency terms. These numbers make it clear that all regions have been affected by the global shocks that have driven performance this year.

Global markets have struggled against inflationary and geopolitical shocks.

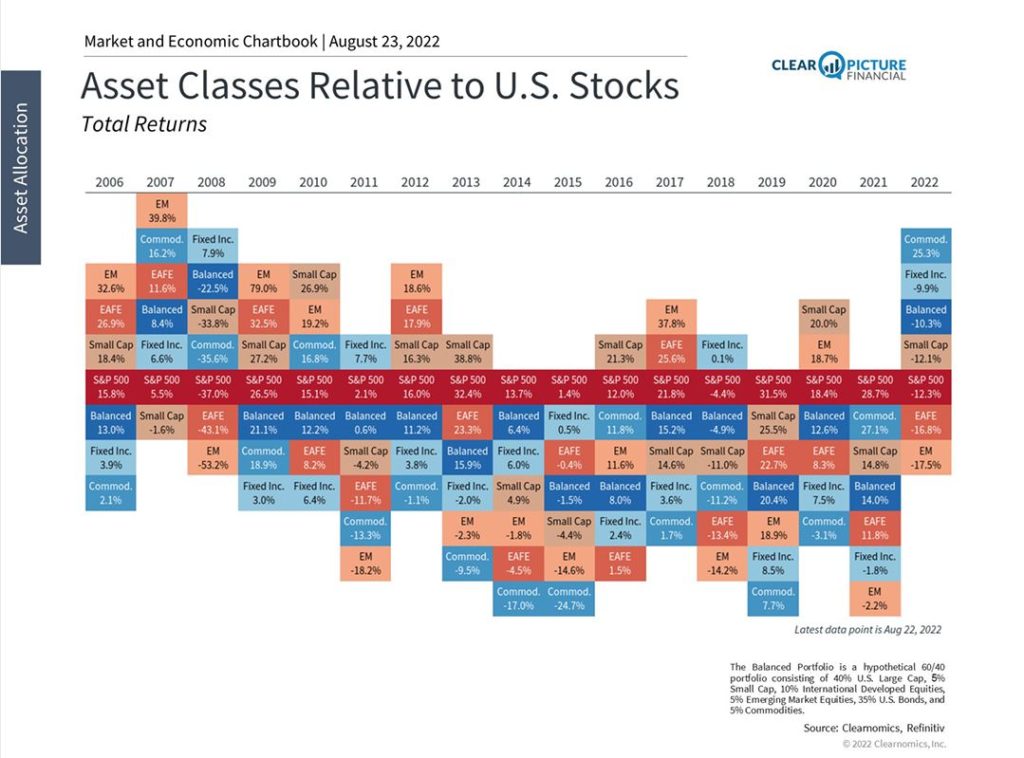

It is also the case that U.S. markets have performed extremely well over the past decade. For some investors, this may be a sign that focusing only on U.S. investments is enough. However, this has not always been historically true. As the chart above highlights, there have been many periods during which both developed and emerging markets have played important roles in balanced portfolios. As the global economy recovers, some of these opportunities could reemerge.

In this challenging environment, there are a few facts that investors should keep in mind. First, international investments, especially in emerging markets, naturally involve greater levels of risk than investing in the U.S. alone. Specifically, there may be political, financial, and regulatory risks related to holding these investments as well as to the underlying companies and industries. Being aware of these risks and managing them well is an important part of holding a global portfolio.

For example, investments in China have been in the news over the past couple of years due to increased scrutiny by the Chinese government. Industries such as tech, education, and financial services have faced new regulations that directly impact their businesses, affect their U.S.-listed stocks, and have even prevented IPOs. More recently, heightened tensions between the U.S. and China over Taiwan have increased the possibility of trade and supply chain disruptions, worsening sentiment in markets and potentially adding other problems.

These risks stem not only from within each emerging market but from the U.S., as well. The Holding Foreign Companies Accountable Act passed by Congress in 2020, for instance, steps up regulation of foreign stocks traded on U.S. exchanges through regular audits. This increases the burden on these companies and can make it more difficult for U.S.-based investors to make international allocations, as failure to comply can put a company at risk of being delisted.

However, these additional risks also create opportunities for patient investors and demonstrate the importance of diversifying across many stocks. In the long run, investors can be rewarded for stomaching greater levels of risk not just in U.S. stocks, but internationally, as well. Today, valuation ratios for developed and emerging markets are not only far below those of the U.S. but are still well below their historical averages at 12.4 and 11.1 times next-twelve-month earnings, respectively. This suggests that there may be many attractive opportunities for investors who are willing to look beyond U.S. borders.

Learn more by listening to our Clear Picture Financial podcast, or by calling Jason Noble at Prime Capital Investment Advisors in Charleston, South Carolina at (843) 743-2926.

082922012 MKS

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd. Suite #150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).