Long has the 4% rule reigned as the most well-known and observed distribution strategy, but it isn’t without issues. Here’s what you need to know.

Summary:

– While the 4% rule can be a basic guide for retirement investors, it isn’t enough.

– Investors should continue to stick to long-term investment and financial plans as they navigate this challenging market and economic environment.

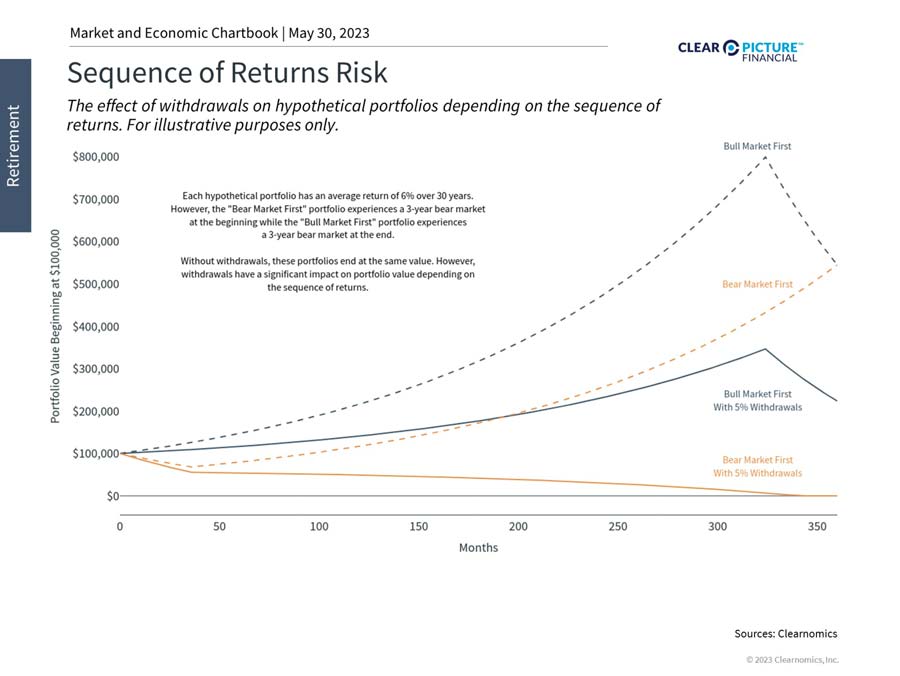

– The sequence of returns can dramatically impact the value of a retirement portfolio.

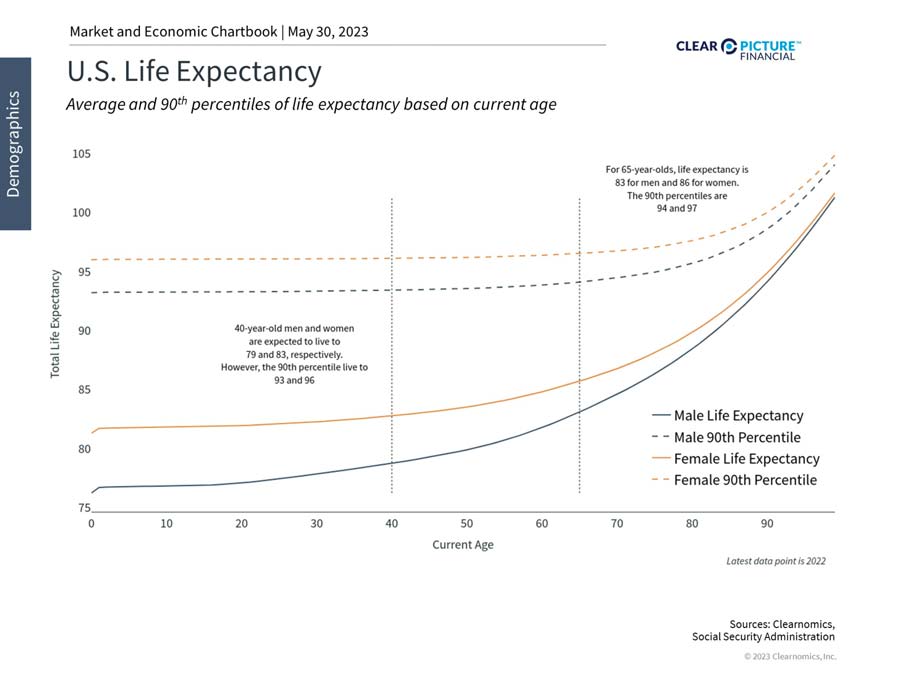

– Life expectancy continues to rise and is an important input to all financial plans.

Planning for retirement has never been more important and yet so challenging. Given the difficult inflationary conditions of the past two years, the risk that worries most retirees continues to be outliving their savings. This is because, when it comes to markets and the economy, we can’t control the timing of events – including day-to-day market swings and whether investors begin retirement in a bull or bear market. What we can control, however, is our own behavior by staying disciplined. Thus, while there are never any guarantees, history shows that having a sound financial plan that can adjust to changing conditions, accompanied by proper financial guidance, is the best way to minimize retirement risks. How can retirees maintain peace of mind and quality of life in today’s environment?

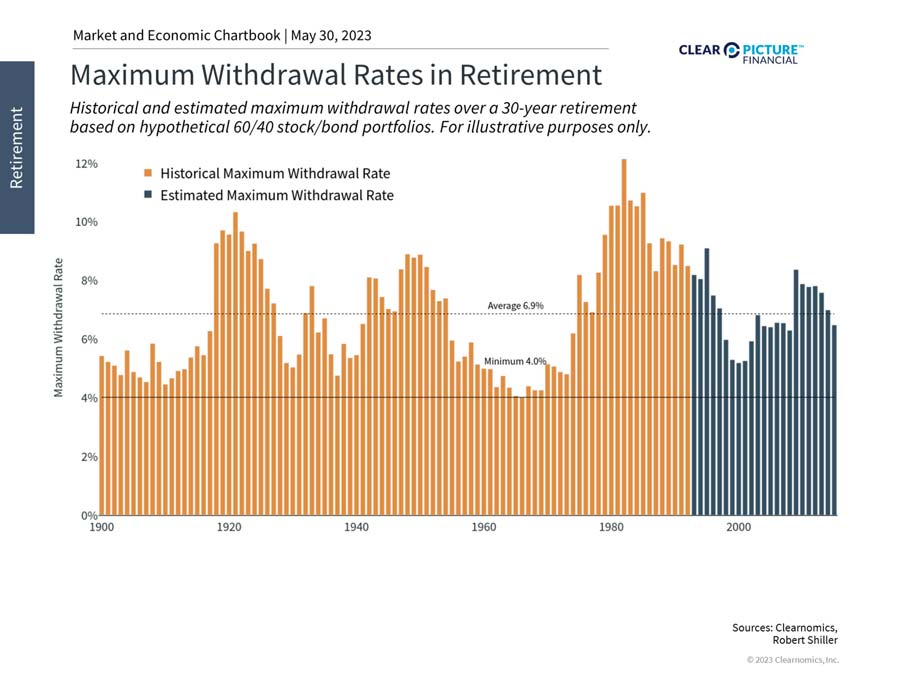

Maximum withdrawal rates have varied over history.

Two of the most important retirement and investment planning concepts are “the 4% rule” and “sequence of returns risk.” In simple terms, the 4% rule attempts to answer the question, “How much can I withdraw from my portfolio each year during my retirement?” This concept was coined by William Bengen, who observed that, historically, a 4% annual withdrawal rate from a portfolio was “safe” in that retirees were unlikely to exhaust their savings over a 30-year retirement horizon, accounting for inflation. For this reason, this is sometimes called the “SAFEMAX rate.”

How does the 4% rule hold up today? The above chart shows the hypothetical “safe” withdrawal rates based on 60/40 stock/bond portfolios and inflation rates across historical 30-year periods and estimates for more recent years. These illustrative calculations show that only once in the 1960s did the maximum withdrawal rate fall as low as 4%. On average, and with the benefit of hindsight, retirees would have been able to withdraw 6.9% each year without running out of funds. Of course, the safe withdrawal rate can vary dramatically from year to year, which should not be surprising given how much market returns can change across a cycle. In general, this pattern is positive for retirees because it suggests that there is a historical basis for steady withdrawal rates of 4% or above.

However, there are several points to keep in mind.

- The 4% rule depends heavily on sticking to an investment plan throughout the full period.

- The analysis is oversimplified, as it does not account for differences in portfolio construction and risk tolerance across individuals, which is a critical part of real-life financial planning.

- 60/40 portfolio may be quite aggressive for many retirees, especially later in life.

- The 4% is based on the initial balance of the accounts going into retirement.

- If the investor has $1,000,000 in their accounts at retirement, they can withdraw $40,000 per year. What about if something unexpected happened or if required minimum withdrawals force them to withdraw more? These scenarios are not accounted for in the 4% rule.

- Simple rules of thumb should be used with caution because they may not account for the sequence of returns or the idea that the timing of bear and bull markets can dramatically impact the value of a portfolio when withdrawals are being made.

- Specifically, when the market is down early in retirement, withdrawing funds amounts to “selling low.” Investors are then less able to take advantage of future bull markets and the wonders of compound interest over the remaining years. Conversely, withdrawing when the market is up (“selling high”) allows the portfolio to maintain a higher value and compound faster, providing a cushion when the inevitable recession and the bear market hits.

- Unfortunately, investors don’t get to choose whether they begin with a bull or bear market – they must adjust accordingly to the hand they are dealt.

The sequence of returns can dramatically impact the value of a retirement portfolio.

Thus, the 4% rule is a helpful place to start but lacks the nuance that may be appropriate in balancing spending and risk throughout one’s retirement. Understanding the various factors that affect withdrawal rates requires financial guidance, and adjusting to changing conditions requires a financial plan sensitive to retirees’ needs.

Life expectancy continues to rise.

Simple rules of thumb also don’t account for increasing life expectancies. For instance, according to the Social Security Administration, 40-year-old men and women today have a life expectancy of 79 and 83, respectively, as shown in the accompanying chart. However, the 90th percentile could live well into their 90s. Similarly, men and women who are 65 years old today could live to 83 and 86, on average, while the 90th percentile could live to 94 and 97, respectively. A decade or longer difference, i.e., a retirement of 20 years vs. 30 years or 30 years vs. 40 years, can have dramatic implications for investment portfolios and financial plans.

The prospect of living longer than expected is often referred to as “longevity risk.” This risk is asymmetric because running out of funds is far worse for most households than leaving money behind for loved ones, charities and more. This means that life expectancy is an important input to any financial plan. Managing longevity risk is another reason all individuals can benefit from professional financial advice.

The bottom line? The 4% rule, while a great starting point, is not concrete. Investors should customize a distribution strategy that accounts for many variables and their unique circumstances, including their life expectancy, their account value, their transitional goals and more.

If you have any questions about your portfolio, your plan or your future, click here to schedule a meeting with me, or call our office at (843) 743-2926. We are here to help you, and we look forward to developing a plan that gives you confidence in your long-term strategy!