It’s almost Halloween so we thought it would be an excellent time to review people’s top fears about their finances, especially people getting close to retirement. Retirement is the start of a new phase of life, and as you get closer to marking the beginning of that new chapter, we want to help you eliminate the surprises that can accompany one of life’s biggest transitions.

Don’t become haunted by fears, looming concerns, or worries. Let’s pull the mask off each issue and reduce your stress by making the unknown known—before you retire.

Financial Fear #1: Inflation

Nothing strikes as much fear into the hearts of retirees as inflation, and for good reason. The best-laid retirement plans can be wrecked by the rapid decline in the value of the dollars you’ve socked away for your golden years. Inflation, having hit a 40-year high in 2022, has left many concerned and worried about the reduced purchasing power of their money accumulated over decades of hard work—money saved specifically to fund their retirement lifestyle.

Not all inflation is created equal, however. The consumer price index (CPI), for example, attempts to capture the activity of all U.S. consumers—and that’s not exactly you. For instance, if the CPI reflects high fuel prices, you may drive an electric car so that inflation factor may not apply. That’s why it’s important to work with a financial professional to focus on your personal situation.

You still have options to address inflation; in fact, many of them. A professional can help you stem inflation’s erosion of your nest egg by utilizing assets that hedge against it in your plan. Proper diversification is the key to combating the inflationary pressures and mitigating the damage, and your financial advisor can guide you through the process of which assets (i.e. commodities, real estate, treasury bonds, etc..) might be best suited for you.

Financial Fear #2: The State of Social Security

Headlines during the last few years have caused panic among pre-retirees afraid that Social Security might not be there when they need it. Back in 1935, when the Social Security program was created, life expectancy at birth was only 58 for men and 62 for women, and the retirement age was 65.

Clearly, Social Security was never intended to be the sole source of retirement income for retirees for the current retirement period of 20 to 30 years that today’s increased longevity now requires. In today’s world, Social Security is intended to help supplement the money you have saved for your retirement in your own personal retirement nest egg.

That’s why it’s essential to go through a holistic and comprehensive planning process with an advisor who specializes in retirement. A retirement specialist will look at the whole picture, including your potential sources of income from Social Security, your 401(k), pensions and other investments, as well as your tax situation, inflation and other retirement risks.

When to file for your Social Security benefits is a common question that your advisor will help answer, and rushing to file early because you are afraid the program will run out of money may not be the wisest approach. Social Security is extremely popular, and while no one has a crystal ball, Congress is likely to make adjustments to ensure that it continues—without cuts for those who have retired.

While you can file as early as age 62, doing so will permanently reduce your monthly benefit amount. Once you reach your Full Retirement Age (FRA, somewhere around age 66-67 now depending on your birth date), you will receive your full benefit. But if you wait even longer, up until age 70, your monthly benefits increase by 8% each year.

It may make sense for you to wait to file, or it may not. The full picture needs to be considered.

Financial Fear #3: Fear of the Unknown

Anything can happen, and retirement can bring on the deep anxiety of “what do I do next” or “what is my purpose” when you are no longer working. Retirement can be an emotionally complex time for many, especially if you were thrust into retirement due to a situation that was out of your control (i.e. layoffs, illness, etc.)

Don’t hesitate to seek help from a professional who can help you understand your fears and help you to work through these issues. Whether you’re nearing retirement or already a retiree, it’s never too late to find passions, purpose, and rediscover the meaning of life. Take this one step at a time to avoid emotional decisions by working with a professional who can assist you in finding your footing. Retirement should be a new beginning that opens up positive new windows and opportunities, affording you the time to pursue the things that you couldn’t get around to before.

Financial Fear #4: Economic Concerns

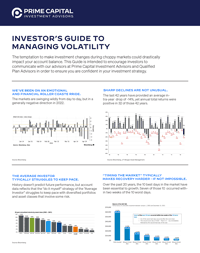

Market volatility, bear markets, fears of recession…these are all very common fears shared by nearly everyone as they get ready to retire.

Economic fears highlight how important it is for your portfolio to be truly diversified, to avoid putting all of your eggs in one basket. Too many people tend to panic when the markets go down, and sell when markets are dropping, but this strategy isn’t feasible for the long-term, nor does it provide a good solution. If your offense falls by the wayside and you sell low, you’re left to simply play defense with what’s left of your depleted nest egg.

Rather than letting uncontrollable markets control you and your financial future, find alternatives that can provide reliable retirement income, allowing you the freedom to hold some of your assets in the market longer, until it comes back up.

Remember, leaping out of stocks because of market lurches is never a good idea. Investors have seen strong gains in recent years, as well as some steep declines. This is where a professional can really explain the importance of considering alternate options. The sooner you begin planning with alternative investment vehicles and utilizing investments that offer more stability and less risk, the better position you’ll find yourself in.

Financial Fear #5: Potential High Healthcare Costs

The high cost of healthcare is a real fear. In fact, Fidelity estimates a couple might need almost $315,000 in today’s dollars—not including long-term care—just to cover medical expenses like Medicare premiums, co-payments, deductibles, and prescription costs in retirement. And medical costs are rising at a rate that’s well above the average inflation rate, meaning you may need to have even more set aside when you retire.

In an effort to keep a potential future illness from eroding your retirement nest egg, your financial professional can help bring practical solutions to your retirement plan to help address health concerns. Some of these may include a specific line item saved for health costs, or adding life insurance, an HSA (health savings account), and specific coverage that can kick in to cover long-term care should you or your spouse need it.

Don’t worry, plan!

Financial Fear #6: Running Out of Money in Retirement

A whopping 61% of people surveyed reported they were more afraid of running out of money than death according to a study conducted by Allianz Life in 2023. And this is understandable, as Census data shows life spans getting longer. The longer you live, the greater your chances of running out of savings, especially if you follow outdated rules built around a shorter retirement.

Sitting down with a financial professional and discussing your situation in detail is both a practical and proactive step in the right direction. Once you meet with an advisor to discuss your goals, needs, plans, investments, potential risks, and more, your advisor can develop a comprehensive and customized plan for you that can guide you to and through your golden years.

If you would like help putting an end to your retirement fears, please give us a call at (843) 743-2926 so that we can discuss your situation and put together a custom plan just for you. Jason Noble, CFP®, RICP®, holds both CERTIFIED FINANCIAL PLANNER™ and Retirement Income Certified Professional® designations and was named number five out of the Top 100 Solo Advisors to Watch in 2023 by AdvisorHub.

Sources:

https://www.ssa.gov/history/lifeexpect.html

This article is provided for general information only and is not to be construed as financial or tax advice. It is recommended that you work with your financial advisor, tax professional and/or attorneys when tax planning.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd. Suite #150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

102623008 MKS