The recent failure of three American banks has raised concerns over the economy and the financial system. The situation is still evolving, and there’s lots of speculation about what might come next. Jason Noble, CFP®, RICP® in his video recorded on March 11, 2023, gives us a breakdown here.

WATCH:

Recent Development

This crisis in banking has already caused hardship for many companies and individuals as payrolls are disrupted and access to cash is halted. But one recent development is that government officials from the Treasury, Federal Reserve and FDIC (Federal Deposit Insurance Corporation) have announced that depositors in the three American banks that failed will be made whole to backstop the system and restore confidence.

What Investors Should Know

Remember, when it comes to investing, it’s more important than ever to stay level-headed and focused on the bigger picture. (That’s why we call our process “Clear Picture.”) So, what should long-term investors know about these bank failures? And what do they reveal about the financial system?

Well, the collapse of Silicon Valley Bank (SVB), was the first FDIC-insured bank failure since 2020 and the second largest in history. This was followed two days later by the failure of Signature Bank, the third largest in history.

Just a few weeks earlier, these two publicly-traded companies had, respectively, the 14th and 18th largest market capitalization levels among US banks. Silvergate Bank, a smaller bank active in the crypto industry, also failed the same week, but went through a more orderly liquidation.

Bank stocks have struggled due to these recent bank failures. But from a market and economic perspective, the main question is whether or not there is a wider or more systemic economic risk to the financial system itself.

What Happened

In our opinion, these particular banks grew too aggressively with too little risk management as tech stocks and crypto values have been volatile over the past few years. While this worked well for them during a bull market, the reversal of these trends and overall markets in 2022/23 made these banks vulnerable to classic bank runs.

How do bank runs occur? A simplified description of the banking model is that customers, both businesses and individuals, deposit funds with banks for safekeeping. Banks then use these deposits to make loans or buy higher-quality investment securities from which they hope they can generate profits. This works well as long as their investment assets continue to grow in value and customers trust in the safety of deposits. If either of these is not the case, the bank may not have the liquidity to meet its obligations.

With this in mind, we believe these recent bank failures were due to two problematic, related issues.

1) The Fed’s Interest Rate Hikes

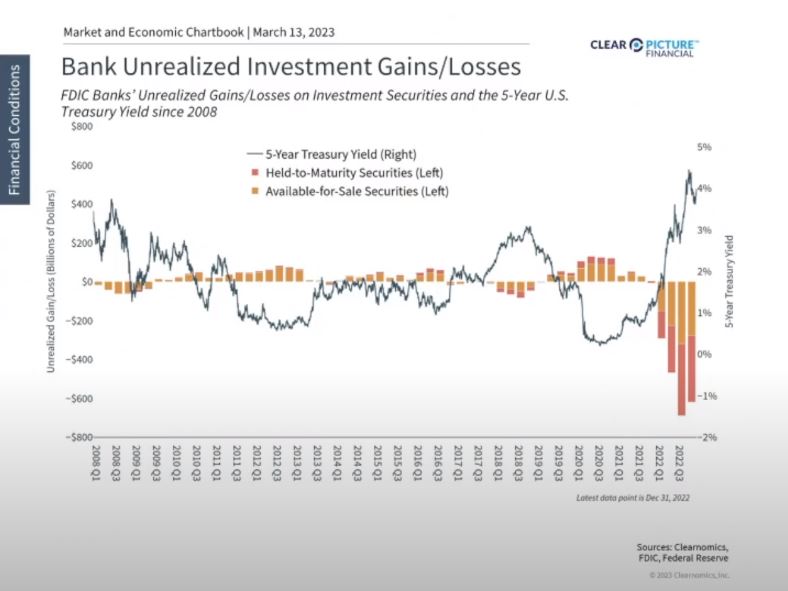

The three banks that failed had accumulated unrealized losses on investment securities as interest rates spiked.

In other words, rapidly rising interest rates, due to hikes made by the Federal Reserve multiple times over the past year, placed financial stresses on the banks’ balance sheets.

In other words, rapidly rising interest rates, due to hikes made by the Federal Reserve multiple times over the past year, placed financial stresses on the banks’ balance sheets.

In fact, bonds had the worst performance in history in 2022, including US Treasuries, driving the unrealized losses on banks’ investment assets.

Whether or not the banks needed to book these losses depended on how their securities were accounted for. But, nevertheless, the situation worsened as they faced pressures on deposits. Thus, SVB and the others found themselves with far less assets on paper—and in reality—as interest rates rose.

2) Concentration on the Tech Sector and Crypto

SVB’s concentration on start-up tech businesses was the second problem. This made them vulnerable as conditions deteriorated for the tech sector, just as Signature Bank and Silvergate found themselves exposed due to the slowdown in the crypto industry they were heavily focused on.

Silicon Valley Bank tried to plug this gap by raising fresh capital, but this backfired since it highlighted the liquidity and insolvency issues they faced. Like shouting “fire” in a crowded theater, once there’s a perception of an insolvency problem, a classic bank run can occur swiftly, becoming a self-fulfilling prophecy.

To a large extent, this played out publicly on Twitter and other platforms as many in the start-up and VC (venture capital) communities urged companies and depositors to move their funds.

Government Actions

While government actions are always controversial and subject to political debate, the quick move by the Treasury, federal government and FDIC to backstop customer deposits across these banks likely helped stop the contagion effect across the entire banking system. At the same time, the government actions didn’t directly address the underlying issue of impaired assets, which depends on the quality of risk and asset liability management at each bank.

However, it’s important to remember that the overall risk that unrealized losses will become an insolvency issue across the banking industry is mitigated by the fact that larger, more diversified banks are less reliant on deposits, have strong deposit bases and maintain higher amounts of capital.

Recent History

These three bank failures are the largest since 2008. One reason that investors may be concerned is that there have been very few bank failures in recent history, especially since bacon legislation, such as the Dodd-Frank Act, was put into place after the 2008 financial crisis. According to the FDIC, there were only eight bank failures from 2019 to 2022, far below the 322 experienced around the 2008 financial crisis, or the hundreds that regularly occurred during the 1980s and 1990s.

According to the FDIC, there were only eight bank failures from 2019 to 2022, far below the 322 experienced around the 2008 financial crisis, or the hundreds that regularly occurred during the 1980s and 1990s.

That being said, Silicon Valley Bank is an outlier, with total deposits of $175B, while the eight banks from 2019 to 2022 had combined deposits of only $628M.

Naturally, parallels are also being drawn back to 2008 where the last wave of bank failures threatened the global financial system. It’s important to remember that back then, the problem was not just that banks held significant amounts of mortgage-backed securities and other housing-sensitive assets that ended up being worth only pennies on the dollar. Rather, a significant amount of leverage coupled with financial instruments, such as collateralized debt obligations, allowed a housing crisis to turn into a financial meltdown.

Today’s Banking System

While it’s not exactly clear how this episode will play out, many banks today are much better capitalized, and do not primarily rely on tech or crypto deposits. Additionally, any economic spillover has been so far concentrated in the technology and venture capital industries, which are already struggling with layoffs and slowdowns.

These developments will probably affect the Federal Reserve’s upcoming rate decisions, since they underscore the unintended consequences of rapid rate hikes. It’s likely that they have created a new sense of caution for the Fed as they continue to battle inflation.

Based on market-based measures, investors no longer expect the Federal Reserve to raise rates again this year, but believe that there may be a rate cut by September. Interest rates have also fallen with the 2-Year Treasury declining more than one percentage point to around 4.1%.

Ironically, this means that the very bonds responsible for unrealized losses on bank balance sheets are now worth more.

While these expectations can shift rapidly, they show how much sentiment has shifted in the past week.

The Bottom Line

While recent bank failures are very problematic, parallels to 2008 are premature. Investors who stay diversified and focused on the bigger picture while the situation stabilizes will probably fare better than those who speculate on a minute-by-minute basis.

This is where having a financial advisor in your corner is so important, so that you don’t make a financial mistake because of a knee-jerk reaction to news. Keeping your portfolio aligned with your overall wealth plan is what we do here at Clear Picture Financial (powered by Prime Capital Investment Advisors). We are here to help you reach your financial goals, and to weather the financial storm we are in due to the current economic environment.

Please reach out to our office at 843.743.2926 and schedule a conversation to see how we can help you.

#032023002 MKS

Jason Noble provides general information, not individually targeted personalized advice, and is not liable for the usage of the information provided. Exposure to ideas and financial vehicles should not be considered investment advice or a recommendation to buy or sell any of these financial vehicles. This information should also not be considered tax or legal advice.

Individuals should consult with a professional specializing in the fields of tax, legal, and accounting regarding the applicability of this information for their situation. Past performance is not a guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell and investment and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd. Suite #150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).