Jason Noble recently appeared on ABC 4’s Lowcountry Live show to discuss why people work with him and his team at Prime Capital Investment Advisors in Charleston, South Carolina.

Prime Capital Investment Advisors and PCIA Charleston help people achieve their life’s ambitions.

Jason Noble says that in full disclosure, while other financial advisors can provide some parallel services, there are around 30% of services that are handled very differently by the team at PCIA Charleston. As retirement and income specialists, Jason says there are three basic reasons people seek his help with their finances, particularly as they get closer to retirement.

First, people are worried about the government essentially “printing money” and then having to raise taxes to pay for it. People are worried about higher taxes, be it income taxes, capital gains, or estate taxes, and they’re looking to PCIA Charleston for strategies to mitigate taxation and offset the risk of potential tax hikes. (Other financial advisors may just work on market investments and the accumulation part of finances, and don’t really provide help with long-term tax planning or planning for taxation retirement.)

The second reason people reach out to Jason Noble and the team is that they may have been saving and funneling money into their retirement accounts for decades, but they haven’t put a plan in place as to how they are going to turn those assets into an income stream that will last through retirement, offsetting taxes and inflation.

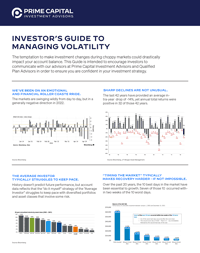

The third reason that people come to Jason and PCIA Charleston is that they feel betrayed by the market. They’ve been saving their whole life and they do not want to see their hard-earned money fall significantly right before or during the early stages of retirement. So, they’re reaching out to find out about downside protection against market drops and how they can navigate this economic environment that we’re in right now. In the last few years these people may have lost 20-25% in the stock market because it’s been so volatile. Some have even gone back to work after initially retiring—some because they had to!

Interest rate hikes are another issue. Interest rate increases undertaken by the Federal Reserve multiple times in 2022 and 2023 have caused mortgage rates as well as credit card interest rates to rise; some credit cards are charging as much as 32% interest now. It just costs more to borrow; money is more expensive now.

Today it’s important to look at your budget, both money in and money out, and make sure you’re handling it properly. Are you tackling debt? Building up emergency savings and cash reserves? And if we go into a recession in the US, are you considering what line of work you’re in when deciding how much money you need to have put away in your emergency fund? It all depends on how much risk you face in terms of losing your job or income. Those are just some of the financial planning issues we address with our Portfolio Payday™ program.

Additionally, estate planning is another important part of your overall financial plan. You should be deciding where your money goes after you pass away, not the state of South Carolina.

A proper estate plan includes at least a will, a durable power of attorney and a medical directive. But there is more you can do. Trusts come into play to address special circumstances, such as if you have a special needs child, or an heir that you know needs spendthrift provisions put into place. These provisions can protect them by releasing inherited funds in small increments through time.

Another very important part of estate planning is having conversations with your heirs now, while you’re here, so that they are completely aware of your wealth transfer plans and are not surprised by any of it later on.

Please reach out to our office at 843.743.2926 and schedule a conversation about these issues and more. We welcome the chance to speak with you.

Don’t miss Clear Picture Financial, Jason Noble’s radio show and podcast each Sunday, where you will learn how you can protect your portfolio and stay on course with your long-term financial and retirement plans. Jason and his team help retirees, those who want to retire early, and business owners who are looking for a work-optional lifestyle.

052323004 MKS

This article is provided for general information only and is not to be construed as financial or tax advice. It is recommended that you work with your financial advisor, tax professional and/or attorneys when tax planning.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd. Suite #150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).