It’s been more than half a century since 1970. What can we learn from a time that looked eerily similar to today?

On June 5, 1970, Life Magazine published the cover below and wrote a five-page report on “Inflation, Recession and a Frantic Bear Market.” To provide some context, let’s go back to when this article was released.

- The Dow Jones Industrial Average (DJI) just dropped 36% within the previous 18 months.

- The DJI was trading at 695.03 on the day this magazine was published.

- The prior Monday had the most significant one-day drop since the assassination of President John F. Kennedy.

- Inflation was at 7%.

- Unemployment was at 4.8%.

- GDP was on the decline for two consecutive quarters.

- Factories were operating at 80%.

- The average computer stock (Nasdaq) fell 80% from its peak in late 1968 to the May 1970 lows.

- Baskin-Robbins introduced their 32nd flavor.

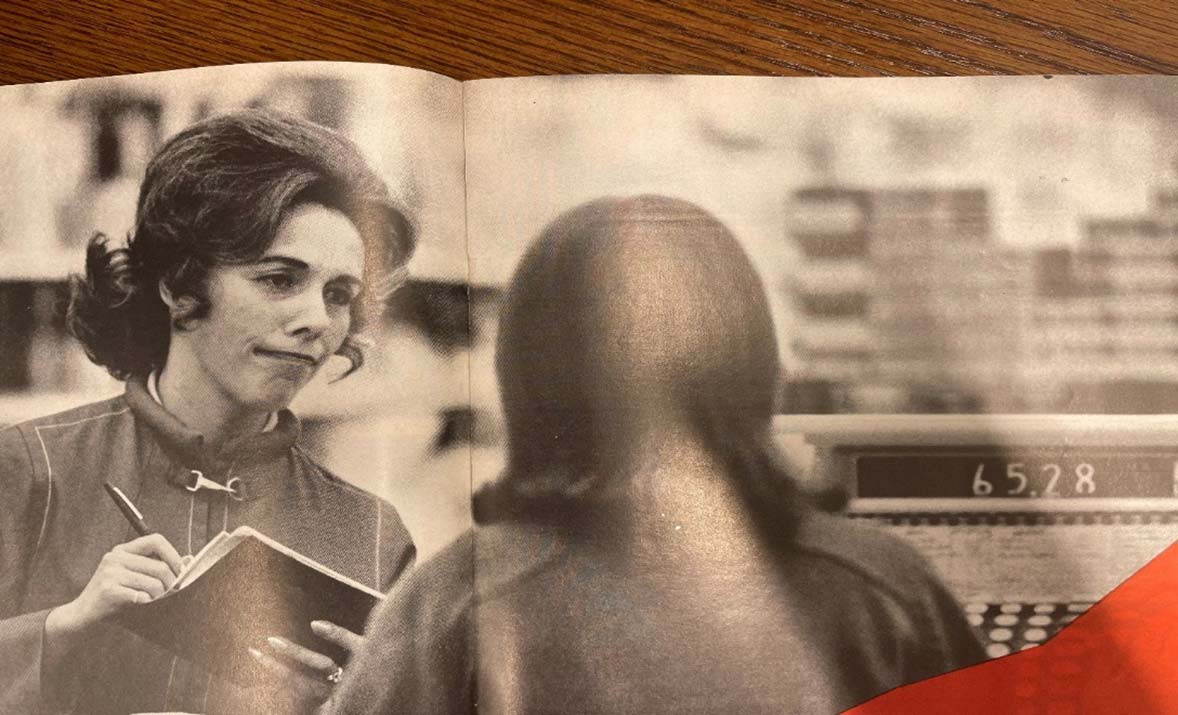

It’s safe to assume there were supply chain issues at that time, as well (probably not a micro-chip shortage though!). The picture below is from the article, showing a woman checking out at the grocery store with a checkbook in hand and the register showing $65.28, and every aspect of her face showed deep concern.

To put this into perspective, $65.28 in 1970 had the same purchasing power as $482.76 in 2022. This picture, like most do, said a thousand words. I couldn’t help but think of what was running through her mind as she had to write that check to pay for her groceries. I believe we all could imagine her thoughts, as we are all in a similar boat during this economy.

So, what happened after the Life Magazine article was published? Well, our vision is always 20/20 in hindsight. Five years later, in June 1975, the DJI was up to 842.15, or a 21.16% return in that timeframe. To take a more extended period outlook, I researched how an all-stock portfolio and a 50% stock and 50% bond portfolio performed from 1970 to 1980. You’ll notice positive returns while inflation stayed high over that decade.

Inflation during that era was the result of the oil crisis, government overspending and the self-fulfilling prophecy of higher prices leading to higher wages leading to higher prices. Stagflation occurs when the economy experiences high inflation, high unemployment and slow growth. However, the market continued on, and here is what the following decade did, from 1980 to 1990.

By now, you are probably seeing similarities between the market described by the Life Magazine article and what we are seeing today. I’ll provide some numbers below for a quick reference.

- The Dow Jones Industrial Average (DJI) is down 11.03% in the previous 18 months

- The DJI was trading at 31,977.09 on the day this newsletter was written.

- In the prior month of September 2022, the DJI dropped nearly 9%, the worst month since March 2020.

- Inflation is at 8.2%.

- Unemployment is at 3.7%.

- GDP has declined in two consecutive quarters.

- U.S. factory capacity utilization rate rose to 80% in September.

- Nasdaq Composite fell 29.8% year-to-date.

- Baskin-Robbins now has 1,400 flavors.

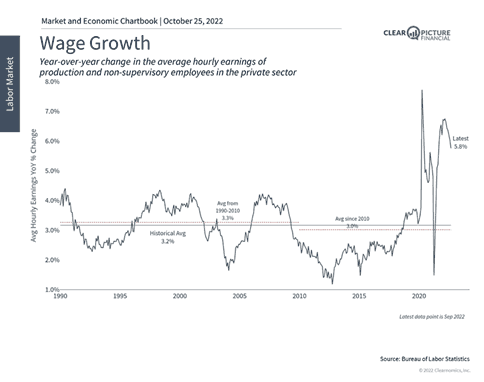

Let’s take some time to discuss how today’s market and economy differ. For one, the Federal Reserve is raising rates to dampen demand and slow wage growth. Although I believe Federal Reserve Chairman Jerome Powell was late in raising interest rates due to his belief in “transitory inflation,” we are now seeing some early positive signs. We now see a slowdown in wage growth, as indicated by the graph below.

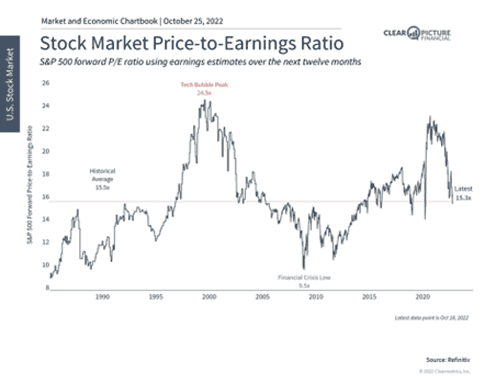

Valuations are more attractive this year due to the market pullback. Leading inflation indicators like shipping costs and commodity prices fell significantly in the past few months. As shown above, other indicators like rents and wages are also slowing down. We also see the Price to Earnings (PE Ratios) go to 15.3x, which is back in line with the historical average of 15.5x. This PE ratio uses next-12-month earnings estimates, so it is forward rather than backward-looking. The chart below depicts what I am referencing.

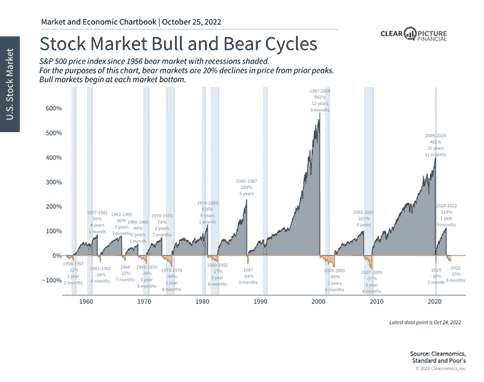

Before I wrap up my thoughts, I still cannot shake the image of that woman checking out at the grocery store and her serious concern washed across her face. One of my thoughts was, what if I was her financial advisor? What could I do to ensure she was in good hands and got through that tough market and economy? I concluded that the answer is exactly what I am doing for my clients and those who reach out for help: discussing the importance of a long-term perspective and reminding her that market timing is nearly impossible, and historically speaking, it pays to be aggressive – or at least resilient – when others are fearful. If her long-term financial plan would NOT be permanently impaired by an additional 10% to 20% drawdown, then we would advise staying invested at this point, as this too shall pass. The last chart below, I promise, shows how the markets work over time.

I hope my message is clear. Even if it’s a 15-minute quick chat, I am here to help anyone who reaches out to talk! I am in the same boat as everyone else, as I do not have a crystal ball or the benefit of hindsight. What I do have is a specific and personalized investment strategy and wealth plan that takes into account challenging and unexpected markets. I can “stress test” your retirement plan and discuss scenarios to give you peace of mind about your financial future and help make any adjustments if needed. Please reach out to schedule a conversation if there is anything you would like to discuss, as I am here for you!

If you have any questions about how inflation can impact your financial plan, please call Jason Noble at (843) 743-2926.

Don’t miss Clear Picture Financial, Jason Noble’s radio show and podcast each Sunday, where you will learn how you can protect your portfolio and stay on course with your long-term financial and retirement plans. Jason and his team help retirees, those who want to retire early, and business owners who are looking for a work-optional lifestyle.

Don’t miss Clear Picture Financial, Jason Noble’s radio show and podcast each Sunday, where you will learn how you can protect your portfolio and stay on course with your long-term financial and retirement plans. Jason and his team help retirees, those who want to retire early, and business owners who are looking for a work-optional lifestyle.

111022005 MKS

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd. Suite #150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).